TL;DR

Rare earth metals are a group of metals that are widely used in modern electronics. Rare earth metal mining and refining are dominated by the People’s Republic of China and present a major choke point the PRC government holds over the world economy. Chinese Communist Party (CCP) politicians have made rare earth manufacturing a focus for the PRC economy, with Deng Xiaoping famously declaring, “The Middle East has oil; we have rare earths.” The Biden administration has made it a priority to create an American ecosystem for rare earth metal manufacturing but faces steep challenges. Today’s post explores the past and present of the rare metal ecosystem and ongoing efforts to establish a rare metal supply chain independent from China.

What are Rare Earth Metals?

The term “rare earth metals” refers collectively to 17 different metals with special magnetic or conductive properties that have proven useful for modern electronics and batteries. Such metals are in fact relatively abundant in the earth’s crust, with the rarest of the rare earth metals 200 times more common than gold (source). As the diagram below shows, rare earth elements are grouped together in the periodic table.

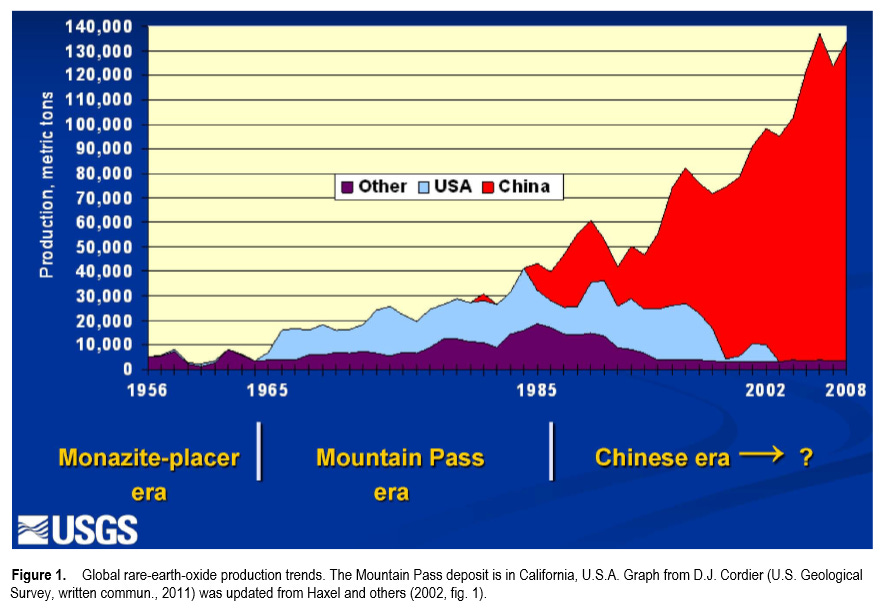

From the 1950s to the 1960s, rare earth metal production was dominated by the Steenkampskraal mine in South Africa (rare earth metals are often found together so single mines have shifted global production multiple times in history). As the diagram below shows, the US led world development of rare earth metals between the 1960s and 1980s, but from the 1980s onwards, China has dominated the production of rare earth metals, with most mining occurring in Inner Mongolia (source). A number of other countries including the US and Australia are working to increase their production of rare earth metals, but China continues to dominate world production for now.

China’s dominance in the production of rare earth metals is due to a combination of smart policy, lower labor costs, and relaxed environmental regulation. As the images below show, rare earth mines place a heavy toll on the environment, a fact which encouraged US policy makers to support off-shoring of rare earth production in the 1980s and 1990s.

Rare earth metals are crucial for manufacturing a variety of electronic components and notably for neodymium magnets, which are broadly used in a variety of industries. The diagram below provides an overview of how rare earth metals are processed into magnets for use in the automotive industry. The majority of the supply chain for rare earth metal processing rests in China, providing the PRC government a chokehold over the rest of the world economy. As we will shortly see, the PRC has already used rare metals to gain leverage in geopolitical disputes.

Rare earth manufacturing and refining is notoriously complex and can cause serious environmental damage by introducing toxins into local soil and water supplies (source). Radioactive waste can leak into surroundings as has happened at the Lynas plant in Malaysia (source). There are concerns that rare earth manufacturing could cause diseases such as cancers, birth defects, or respiratory diseases in humans and in livestock (source).

2010 Rare Earths Trade Dispute

Starting from 2006, the PRC has placed duties and import quotas on rare earth metal exports. In 2010, the PRC reduced its export quotas for rare earth metals by 40%, sending rare earth metal prices outside China soaring. Environmental considerations were cited as the reason for export controls, but external powers including the US viewed these controls as disguised protectionism giving an edge to Chinese companies. Following tensions with Japan over the 2010 Senkaku Boat Collision Incident, the PRC cut off exports of rare earth metals to Japan as a form of punishment.

The US brought a case to the WTO arguing against China’s export controls. The WTO’s dispute settlement body eventually ruled against the PRC, which dropped export quotas in 2015. However, the PRC retains its dominant position in rare earth metals manufacturing today.

Policy Efforts to Change the Status Quo

Rare earth metal refining is notoriously challenging, which has led to difficulties as US and other Western companies have attempted to catch up to Chinese manufacturers. American funding agencies have directed work towards lowering rare earth dependence, with efforts such as the ARPA-E REACT program, founded in 2011, that has funded efforts to lower dependence on rare earth metals in energy applications with some success. More recently, a number of different bills such as the Onshoring Rare Earths (ORE) act, and the Reclaiming American Rare Earth (RARE) act have been proposed to improve American rare earth supply chains. Other companies are attempting to improve rare earth recycling.

Biden’s recent infrastructure plan pledges investment into rare earth refining projects (source), but it may take years yet for these efforts to yield real results (source). The rare earths industry faces multiple challenges. Chinese companies have considerably lower labor costs, with a major Australian miner, Lynas, reporting $10/kg mining costs compared with an average of $7/kg for Chinese producers (source). Margins are low; a magnet manufacturer in the UK reports that 90% of revenue has to be used to pay for raw materials. The PRC has historically played hardball to drive other manufacturers out of the rare earth market, and US efforts may need on-going governmental support in order to compete.

Discussion

Breaking PRC dominance of the rare earth metal ecosystem will prove crucial for the US in the coming years. American defense suppliers are now dependent on Chinese rare earth metal companies (source). As tensions between the US and China increase, it will become increasingly important for the US to develop a supply chain for rare earth metals that is independent of China. Otherwise, the US could lose considerable leverage at the negotiating table with China in future disputes.

However, the challenge is formidable, and a decade of effort in the US and other countries following the 2010 rare earths trade dispute has yielded only minimal progress. Considerable investment into the development of new mines, new manufacturing techniques, and new recycling techniques will be required to change the status quo.

Highlights for the Week

https://www.wsj.com/articles/ceos-plan-new-push-on-voting-legislation-11618161134: https://www.wsj.com/articles/ceos-plan-new-push-on-voting-legislation-11618161134

https://www.anandtech.com/show/16610/nvidia-unveils-grace-a-highperformance-arm-server-cpu-for-use-in-ai-systems:Nvidia is building out its own CPUs

Feedback and Comments

Thank you for reading our subscriber-only newsletter! We’re still figuring out the rhythm for these posts, so if you have feedback on changes you’d like to see, please send them over to bharath@deepforestsci.com! If you’d like to see more financial analysis, or more technical analysis, or deeper dives into a particular industry let me know and I’ll see what we can do.

About

Deep Into the Forest is a newsletter by Deep Forest Sciences, Inc. We’re a deep tech R&D company specializing in the use of AI for deep tech development. We do technical consulting and joint development partnerships with deep tech firms. Get in touch with us at partnerships@deepforestsci.com! We’re always welcome to new ideas!

Credits

Author: Bharath Ramsundar, Ph.D.

Editor: Sandya Subramanian