TL;DR

In today’s post, we dive deeper into the space launch market in which SpaceX operates to do an analysis of its competitors and some of the geopolitics involved. As space technologies grow cheaper and more accessible, countries and companies have been racing to expand their influence and scale. SpaceX’s competitors are geopolitically backed and deep-pocketed, so the company will have to continue innovating rapidly to retain its lead.

A Brief History of the Space Launch Market

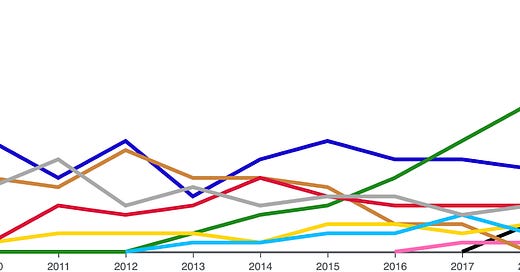

Originally, space launches were solely performed by national governments, the only entities capable of raising the immense amount of resources required. Over the decades though, space technologies have matured and slowly dropped in price, making it more feasible for private players to enter the launch market. Starting in the late 20th century, however, aerospace companies started to enter the launch market, as governments slowly embraced deregulation of space in a bid to lower expenses. Competition heated up in the mid 2000s as US government contractors and agencies increasingly started to lose ground to cheap Russian launch services that reused cold war technologies. SpaceX adeptly stepped into this void and has increasingly come to dominate the growing space launch market, as the chart below shows. However space is a young industry and existing players still have a shot at recapturing the market.

Arianespace

Arianespace was founded in 1980 as the world’s first commercial launch service provider (source). Arianespace broadly serves as the EU’s internal launch provider, with its ownership spread across a number of EU supplier nations. Ariancespace’s primary launch site is in French Guiana. Arianespace’s workhorse launcher is the Ariane-5, but the firm is working on a cheaper new version, Ariane-6, in a bid to lower prices.

International Launch Services (ILS)

ILS was formed as a partnership between Lockheed Martin and Russia’s Khrunichev and Energia to provide cheap launch services by leveraging cold war missile technology. ILS is headquartered in the US, but is primarily Russian owned. ILS had major market share in the late 2000s and early 2010s but has recently lost market share to SpaceX. ILS is attempting to recapture its lead with its new Angara rockets (pictured below).

United Launch Alliance (ULA)

ULA was created in 2006 as a joint venture between Lockheed Martin and Boeing (source). The original goal of the company was to guarantee the US government an assured space launch partner. ULA has struggled to compete with SpaceX, with multiple rounds of layoffs (source).

ULA is attempting to recapture its market position with its new Vulcan Centaur launch vehicle. There are signs that ULA is becoming more competitive with SpaceX on costs, as recent analyses indicate that ULA launch prices and SpaceX launch prices are now comparable (source). Elon Musk took to Twitter to blast ULA as a “complete waste of taxpayer money,” suggesting that rivalry between the two companies is heating up (source).

Indian Space Research Organization (ISRO)

India does not yet have a private launch sector, but ISRO has been making major strides towards maturing the Indian space market by enabling cheap and ambitious space launches. The Indian space effort has picked up considerable domestic enthusiasm in India, with Bollywood even shooting a blockbuster Indian space film.

China National Space Administration (CNSA)

CNSA was founded in 1993 to accelerate the People’s Republic of China (PRC) efforts to boost its space program. The Wolf Amendment passed in 2011 prohibits collaboration between NASA and CNSA following information that previous collaborations had been used by the PRC to develop its intercontinental ballistic missile (ICBM) program (source). As we have seen in past issues, the PRC adopts a very hard nosed attitude to growing its internal technology capabilities and doesn’t hesitate to resort to IP theft as needed. CNSA has led development of the Long March series of rockets, with the latest generation Long March 11 launched from a platform at sea (source).

Discussion

As we learned in last week’s post, SpaceX has made a number of noticeable technological advances. These advances have allowed SpaceX to increasingly dominate the commercial space launch market. However a number of sophisticated and deep-pocketed competitors are racing to catch up to SpaceX. Space and geopolitics remain intricately linked, so the US government has a vested interest in encouraging the growth of SpaceX. But for the same reasons, SpaceX’s competitors will also continue to innovate, funded by rival powers such as the PRC, so SpaceX will need to continue innovating at a rapid pace in order to maintain its lead.

Highlights for the Week

https://spectrum.ieee.org/tech-talk/telecom/wireless/acoustic-amplifier: New acoustic amplifiers have been built with semiconductor manufacturing techniques that are dramatically smaller than previous designs.

https://www.wsj.com/articles/u-s-conducts-airstrikes-in-syria-and-iraq-against-iranian-backed-militias-11624835752: Biden launches airstrikes in Syria and Iraq.

Feedback and Comments

Thank you for reading our subscriber-only newsletter! We’re still figuring out the rhythm for these posts, so if you have feedback on changes you’d like to see, please send them over to bharath@deepforestsci.com! If you’d like to see more financial analysis, or more technical analysis, or deeper dives into a particular industry let me know and I’ll see what we can do.

About

Deep Into the Forest is a newsletter by Deep Forest Sciences, Inc. We’re a deep tech R&D company specializing in the use of AI for deep tech development. We do technical consulting and joint development partnerships with deep tech firms. Get in touch with us at partnerships@deepforestsci.com! We’re always welcome to new ideas!

Credits

Author: Bharath Ramsundar, Ph.D.

Editor: Sandya Subramanian