A Deep Dive into ASML

Estimated Reading Time: 10 minutes

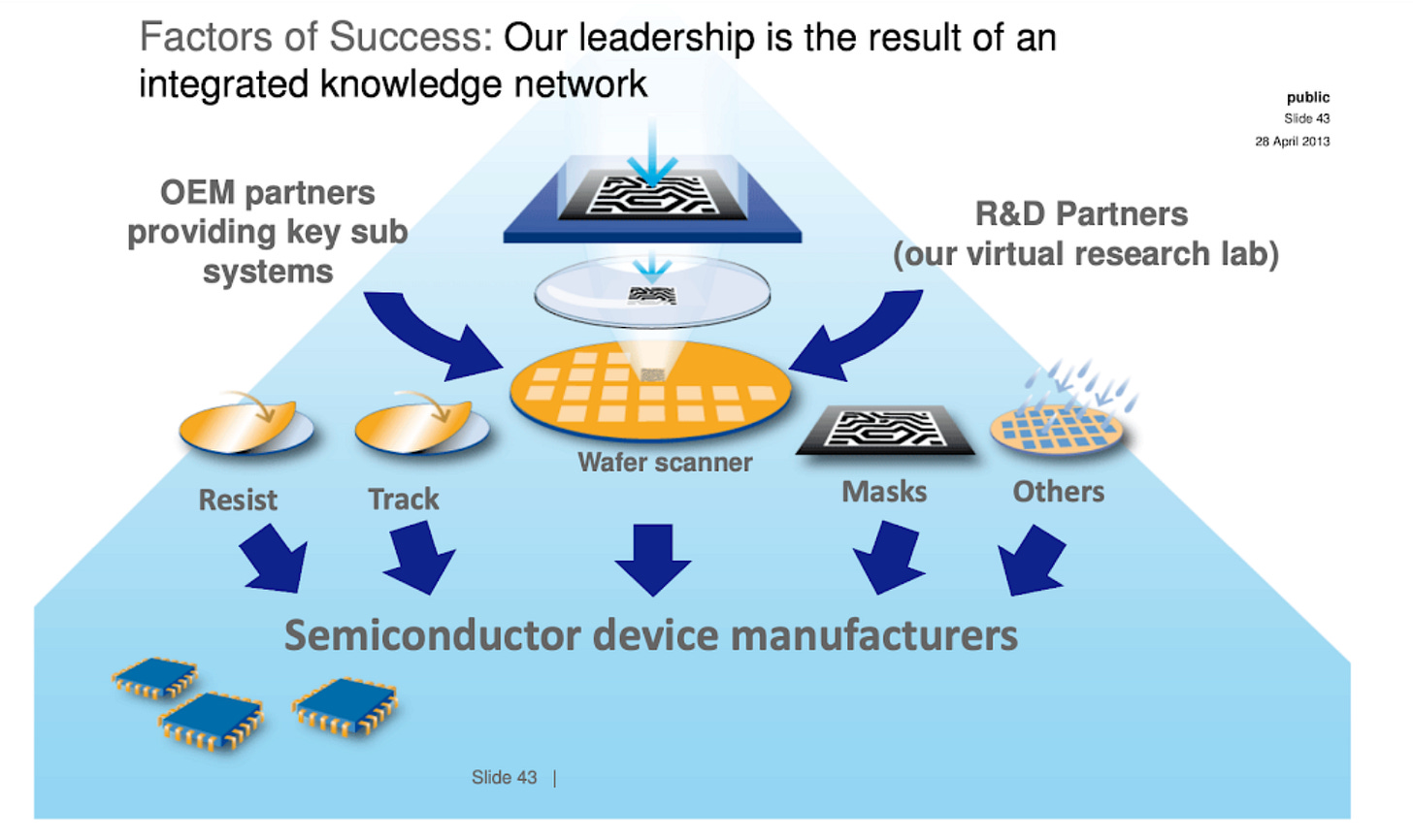

Welcome to the first subscribers-only post for Deep into the Forest! As we discussed in a previous post, ASML is a Dutch company that occupies a critical place in the global semiconductor industry as the sole manufacturer of EUV lithography machines. These machines are extraordinarily complex and expensive. ASML’s unique technological monopoly has propelled it to achieve a $200 billion market capitalization. In today’s post, we will do a deep dive into the company’s financials, aiming to understand the structural factors underpinning ASML’s success. Summarized briefly, we argue ASML’s triumph is due to sustained investment in research and development, and a carefully cultivated network of suppliers.

ASML company overview

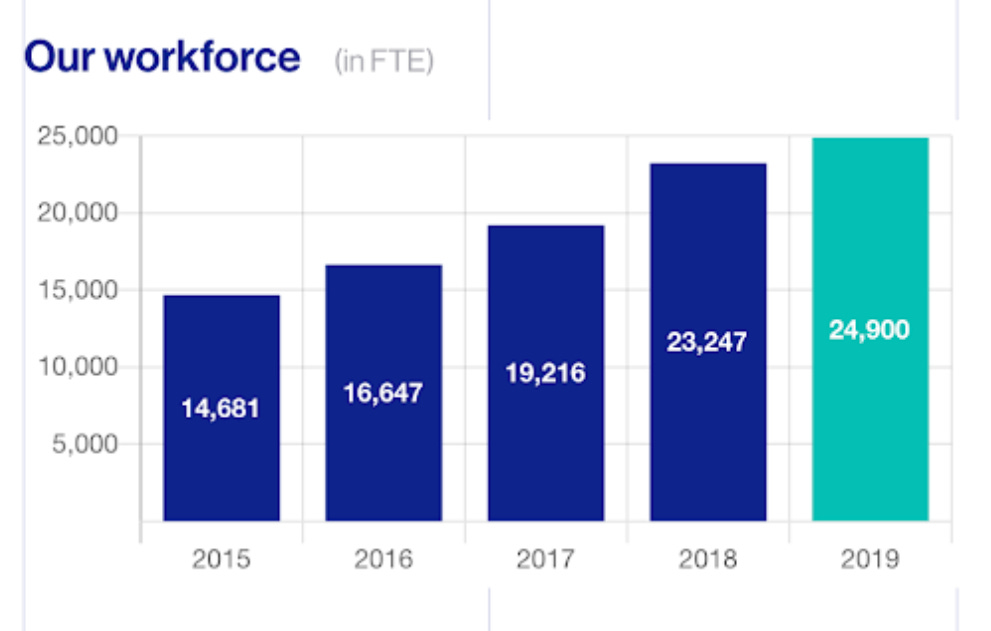

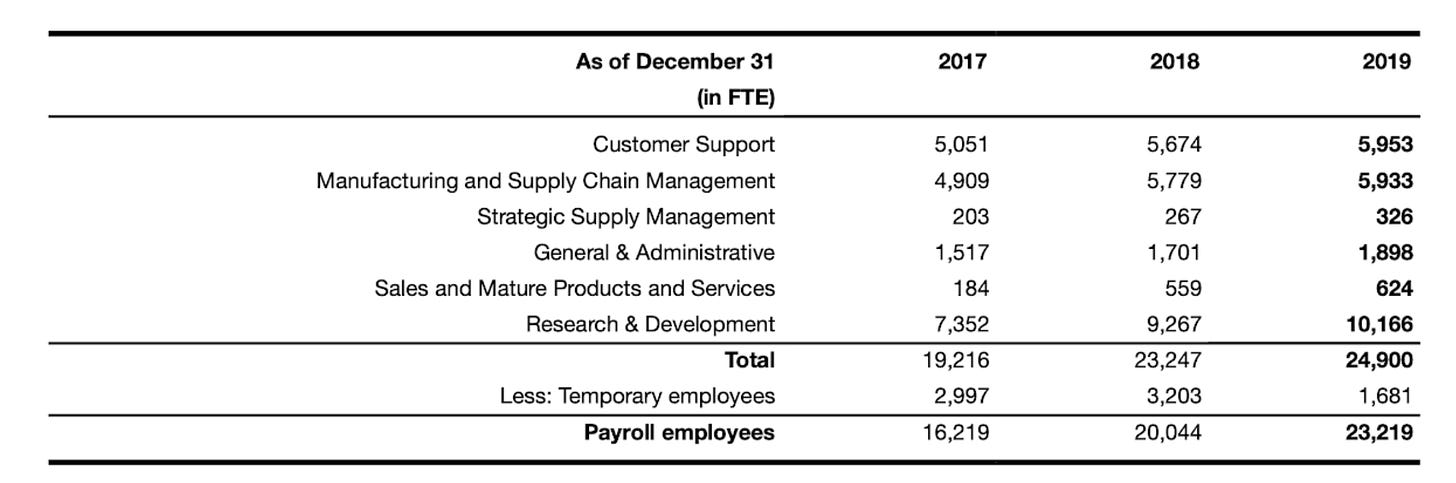

ASML is a large company, with 24,900 employees as of 2019. About half of these employees are based in the EU, with roughly a quarter of its employees in the US and a quarter in Asia. ASML has been steadily growing its workforce over the last few decades, adding over 10,000 new employees over the last 5 years.

ASML has a very large research and development wing, with over 10,000 R&D employees (see employee chart below for a more fine grained breakdown). ASML’s heavy focus on researchers is somewhat unusual for a large corporation, but reflects the sheer complexity of building EUV lithography machines. ASML has been a global leader in lithography for decades, with its first lithography machine shipped in 1984.

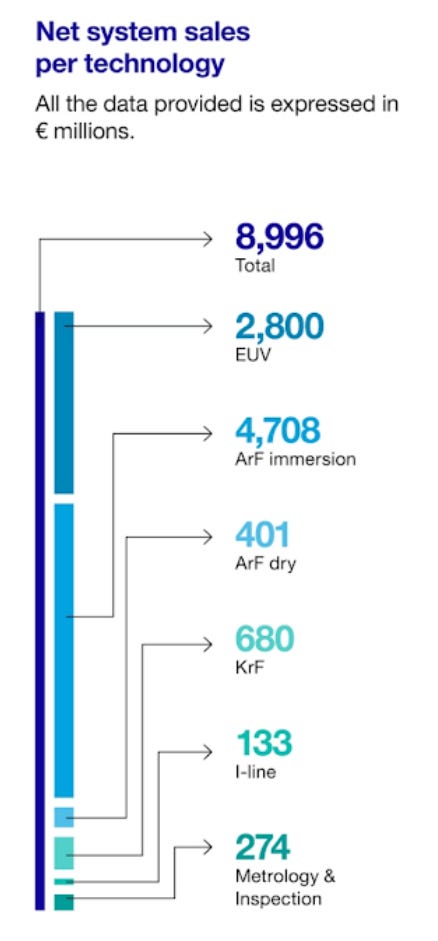

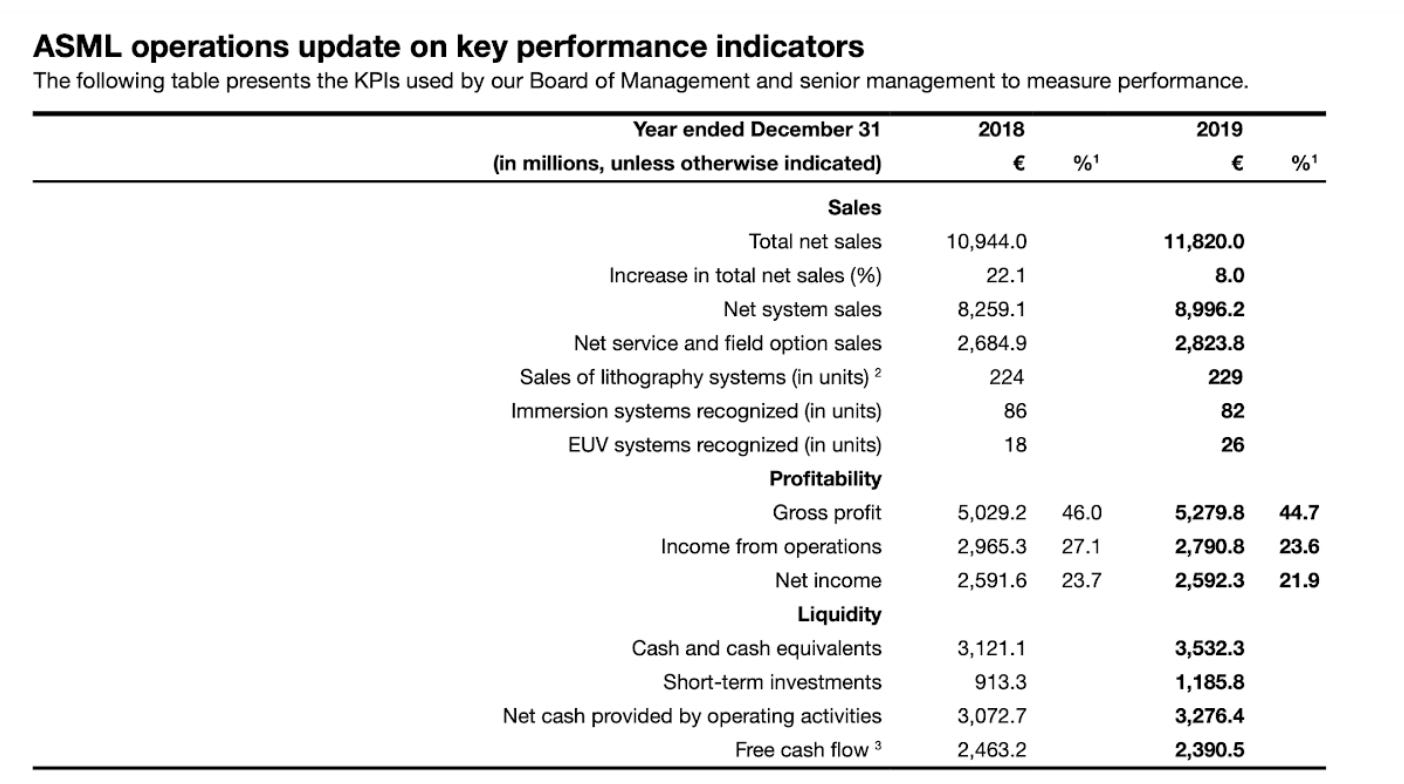

ASML sales in 2019 came out to 11.8B €, with a total of 26 EUV machines shipped that year. Of that revenue, roughly 9B € were from new systems sales and 2.8B € from maintenance revenue. The vast majority of ASML’s 2019 sales came from Asia as the chart below shows.

ASML has a track record of excellent repair and maintenance guarantees; ASML still supports lithography machines first sold in 1991 and plans to do so till 2030! The semiconductor industry continues to use older lithography systems for a variety of applications such as for memory chips, internet of things (IoT) applications and more. ASML also has smaller product lines in metrology and inspection.

ASML is a narrowly focused company with deep technical bets on a few product lines. These bets have undoubtedly paid off, but also mean that ASML is vulnerable to technical disruption. If a suitable affordable replacement for their EUV machines were discovered, ASML profit margins could be undercut. But for now, ASML enjoys a bountiful 44.7% gross profit and 21.9% net income. For comparison this is a higher gross profit margin than Apple, which has achieved a max gross profit margin of 39.1% in the last five years! (source)

Suppliers and Supply Chain

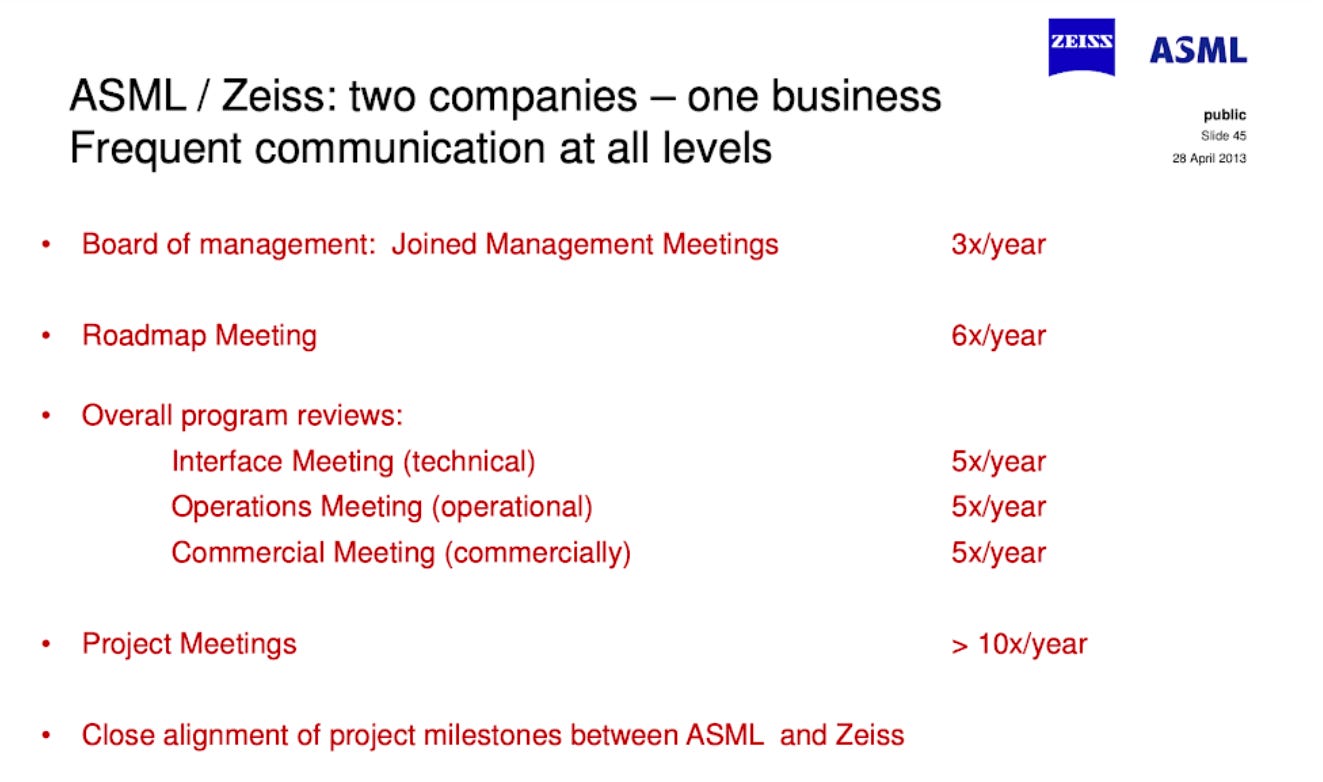

ASML depends on an extensive network of suppliers. As of 2019, ASML had 790 product related suppliers, and 4200 non-product related suppliers. One of ASML’s core strategic advantages is a dense network of trusting partnerships with suppliers. In particular, ASML has worked closely with Carl Zeiss SMT for decades. The two companies have a shared motto, “Two Companies, One Business” that speaks to their unusually close ties. ASML acquired a 24.9% stake of Carl Zeiss SMT on June 29th, 2017 (source), so it may be accurate to think of Carl Zeiss SMT as closer to a separately managed subsidiary of ASML than as a standalone business.

ASML spends heavily on R&D. In 2019, it spent a total of 2.0 billion € on research and development, including 500 million € invested in partners like Carl Zeiss. ASML has carefully nurtured a tightly knit set of suppliers. Many of these suppliers sell specialized EUV parts only to ASML. This tightly integrated supply chain is one of ASML’s most powerful advantages and will be extremely difficult for any competitor to recreate.

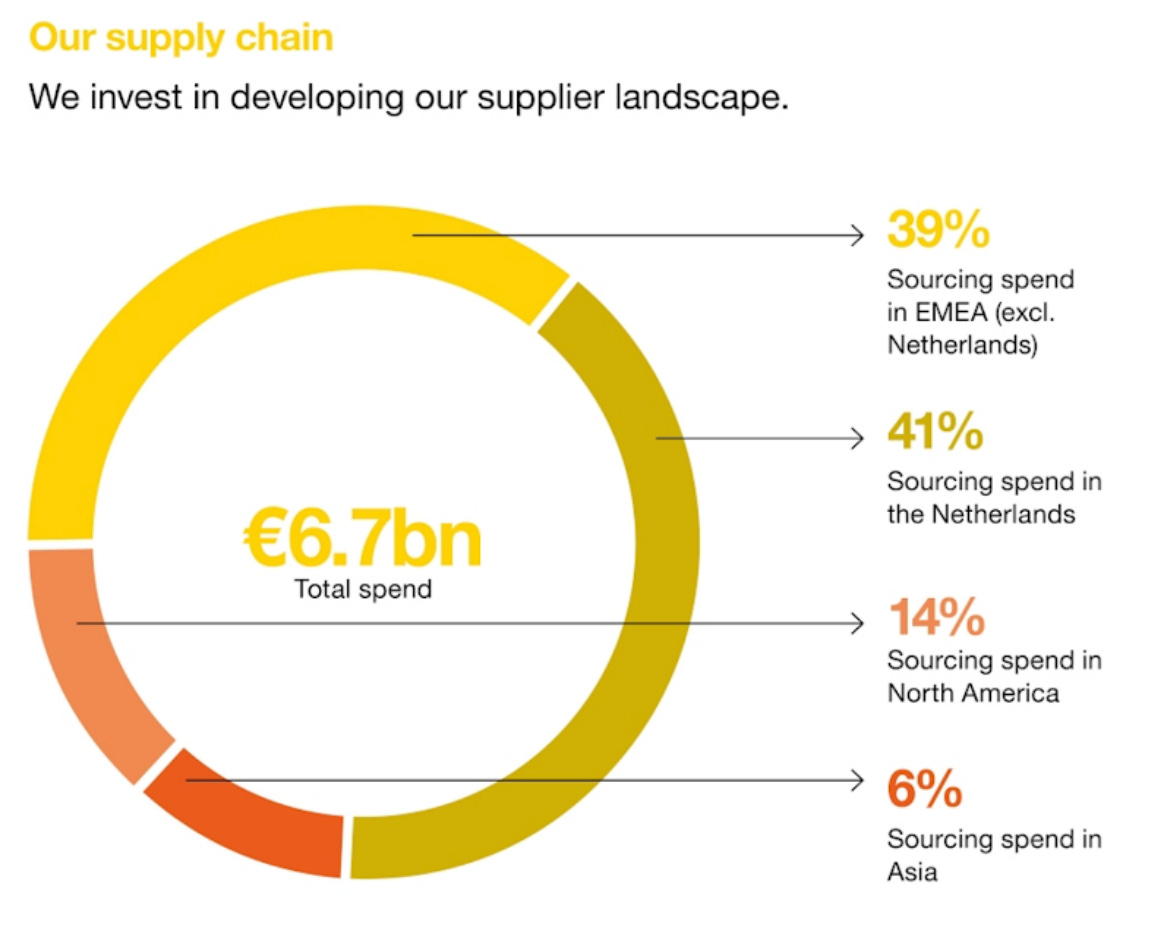

One potential downside to ASML’s strategy is that it becomes dependent on a complex and specialized supply chain. To manage supply chain risk, ASML has grown a supply chain locally, with about 80% of its supply chain spending going to the Netherlands and the EU more broadly.

ASML Research Challenges

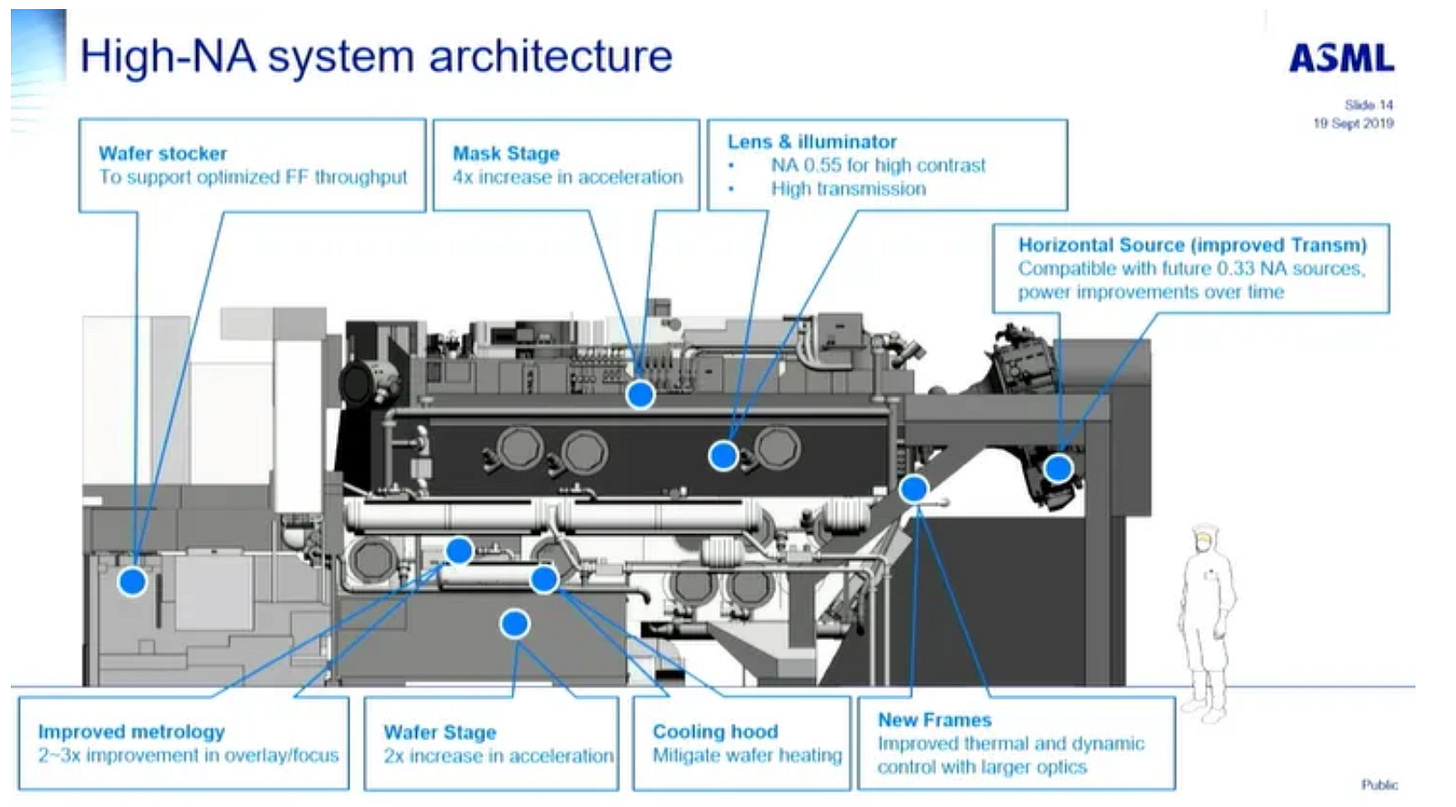

ASML is a critical driver of Moore’s law. If ASML fails to deliver on a next generation EUV lithography machine, semiconductor scaling efforts at TSMC, Samsung, and Intel will flounder. ASML’s next generation high numerical aperture (High-NA) EUV machine is well underway (source). Enabling EUV lithography to successfully manufacture 2nm processors will require major upgrades to the optics system of the machine with a host of other power and system changes besides as the figure below indicates.

Dividends Program

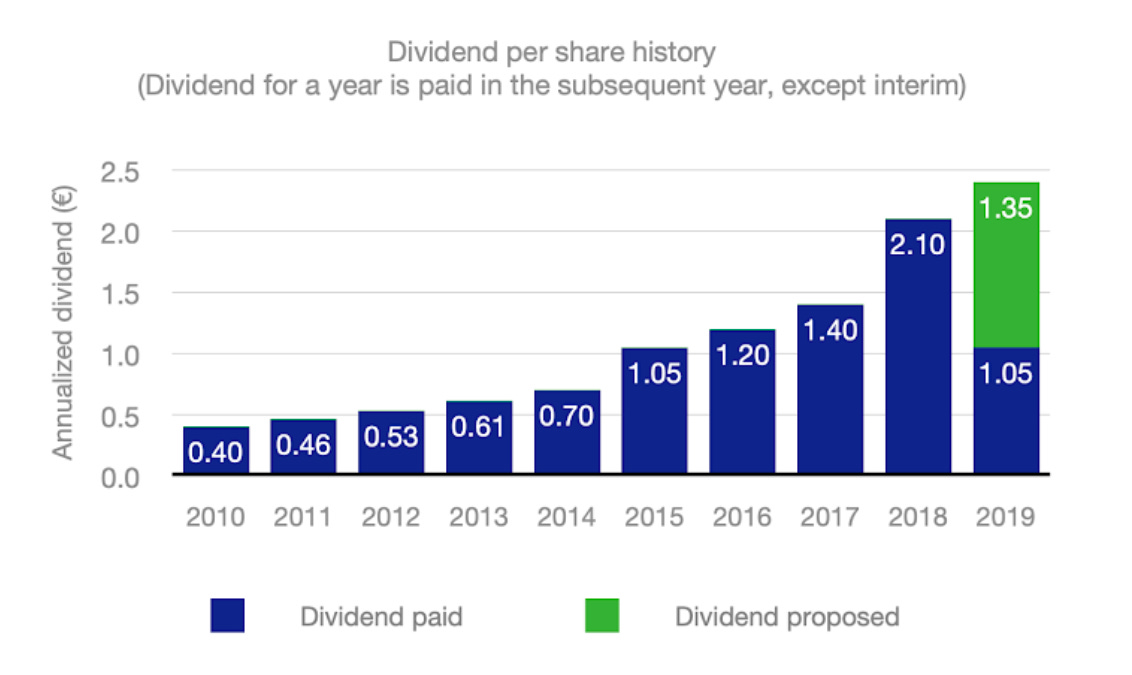

ASML is a mature stable business that occupies a unique monopoly position in the semiconductor industry. Its decades long research bet on EUV lithography has paid off handsomely, and ASML management has chosen to return a healthy amount of its earnings to shareholders through buybacks and dividends. The two charts below show the steady increase in cash return to shareholders over the last decade.

While these dividends are arguably well deserved by shareholders for their patience with ASML’s long-term research bets, these funds are not being reinvested in ASML’s core business, which may prove injurious to ASML’s long term well-being.

Discussion

ASML is a well run company that has cultivated powerful advantages through decades of careful nurturing of supply chains and R&D efforts. These long term bets have paid off with a unique monopolistic role in the global semiconductor industry. ASML has formed close partnerships with a number of research institutions, including IMEC in Belgium, the Shanghai Integrated Circuit Research and Development Center in China, and a number of European research institutions. Strikingly, this list doesn’t include any top American institutions! A comparable state of affairs in genomics would entail having the world’s only sequencing company being based in the Netherlands and no interest from top research universities in the subject.

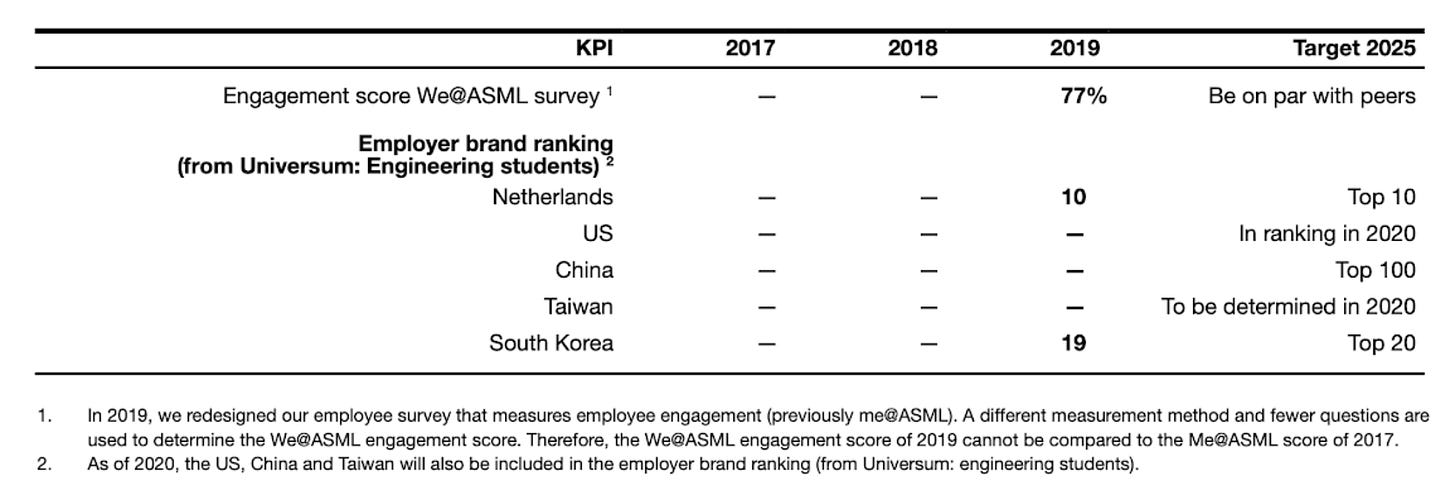

ASML as a brand seems to have poor connections with the American ecosystem. As the chart below shows, ASML has very low name brand recognition with American students. There could be very fruitful collaboration between ASML and top American research institutions whereby American researchers learn more about modern EUV techniques and ASML gains access to top tier research students at American institutions.

Government subsidies could also be used to encourage ASML to commit to manufacturing EUV lithography machines within the US. Without domestic manufacturing capability that can answer to the defense production act, the US could face crucial chip shortfalls in times of need, especially if supply chains between the US and EU are disrupted due to trade wars or other worries.

ASML is an undoubtedly impressive business, but does have some potential weaknesses. In particular, the increasing pace of stockholder cash returns suggests there may be a diminished appetite for bold transformative research that could potentially disrupt ASML’s core business. It seems unlikely for example that ASML would invest in research to make EUV lithography less expensive! ASML will likely continue to hold a unique and differentiated niche in the EUV lithography ecosystem, but the ecosystem has a need for players that offer more affordable options. Policy makers, investors and entrepreneurs should work to make affordable EUV lithography a reality.

Feedback and Comments

Thank you for reading our first iteration of the subscribers-only newsletter! We’re still figuring out the rhythm for these posts, so if you have feedback on changes you’d like to see, please send them over to bharath@deepforestsci.com! For example, if you’d like to see more financial analysis, or more technical analysis, or deeper dives into a particular industry let me know and I’ll see what we can do.

About

Deep Into the Forest is a newsletter by Deep Forest Sciences, Inc. We’re a deep tech R&D company specializing in the use of AI for deep tech development. We do technical consulting and joint development partnerships with deep tech firms. Get in touch with us at partnerships@deepforestsci.com! We’re always welcome to new ideas!

Credits

Author: Bharath Ramsundar, Ph.D.

Editor: Sandya Subramanian